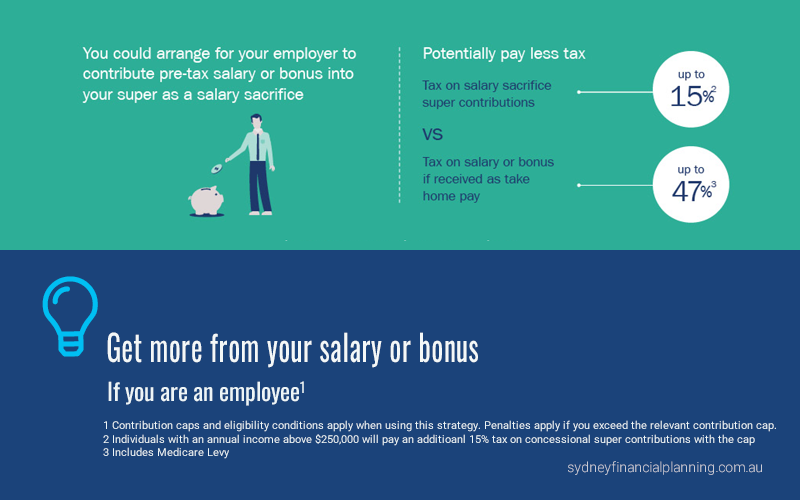

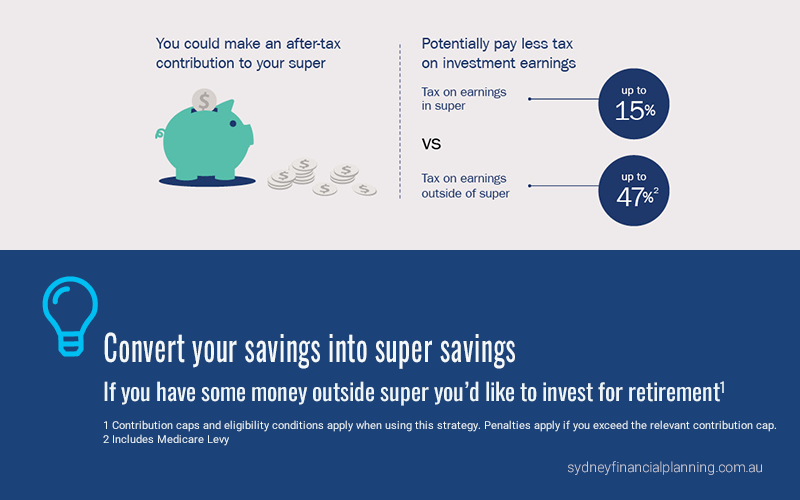

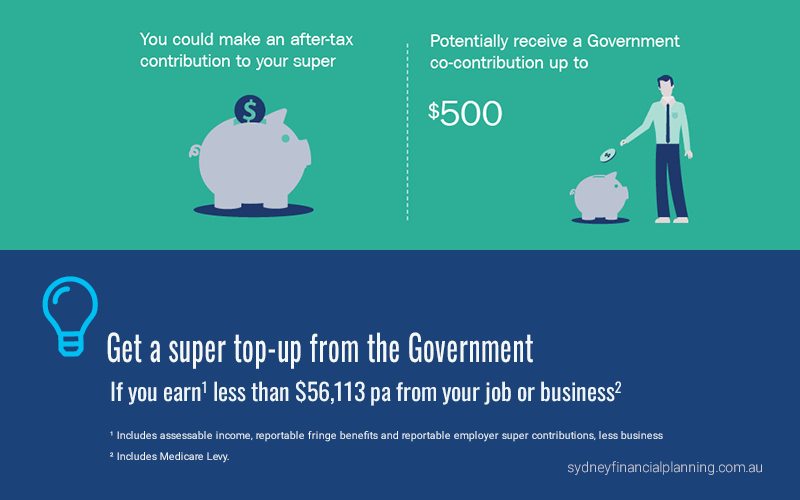

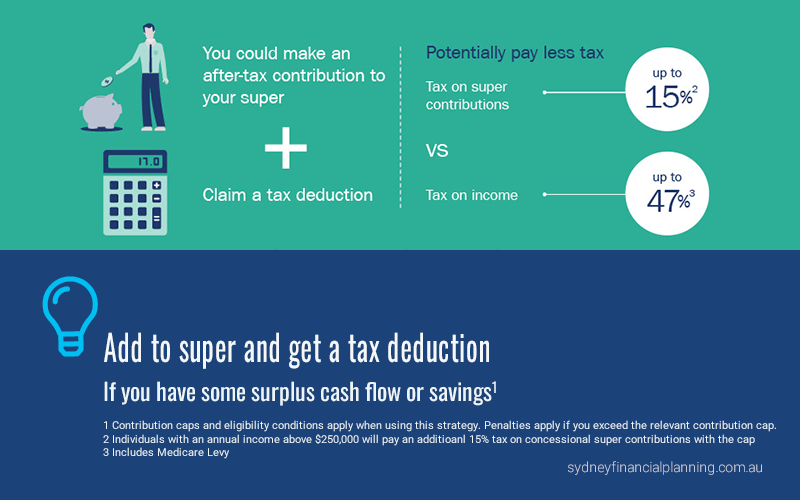

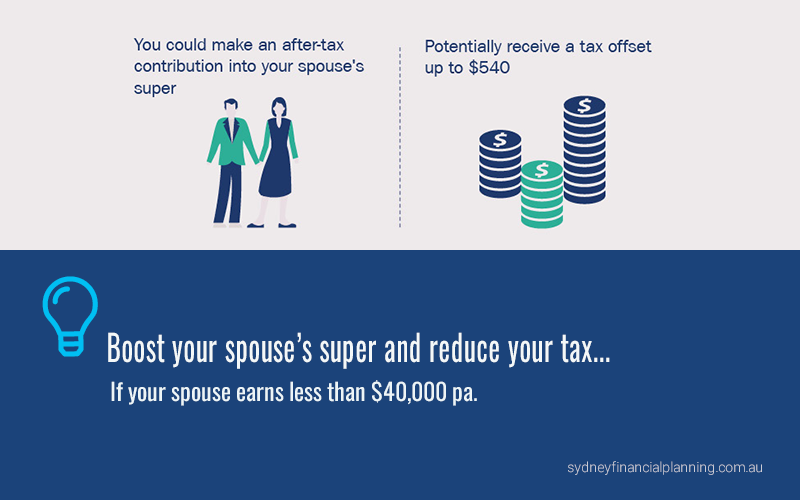

Want to help boost your retirement savings while potentially saving on tax? Here are five smart super strategies to consider before the end of the financial year.

Get in touch or make an appointment

Meet Our Planners

Edgecliff

Suite 13 / 201

New South Head Rd

Edgecliff

NSW 2027

Corrimal

Shop 1 / 225

Princes Highway

Corrimal

NSW 2518

Crows Nest

Suite 11 / 300

Pacific Highway

Crows Nest

NSW 2065

02 9328 0876

Come visit us by appointment at one of our three office locations.