Mainstream and financial media keep presenting us daily with the ever-present worry list surrounding investment markets that relates to economic activity, profits, interest rates, politics, etc. Or by the perennial predictions of an imminent crash.

Or by talk of the next best thing that’s going to make you rich.

The investment world is far from predictable and neat. In fact, it’s the exact opposite – the uncertainty is the only certainty we have. It’s well known for sucking investors in during the good times and spitting them out during the bad times. We hear claims that investing ‘has become more difficult’ in recent years reflecting a surge in the flow of information and opinion. This has been magnified by a digital media where everyone is vying for attention and the best way to get this attention is via headlines of impending crisis. This all adds to the uncertainty and potentially erratic investment decisions.

Against this backdrop, we present you with eight key things for investors to bear in mind in order to be successful. But how does the coronavirus pandemic impact these? This note reviews each in view of the pandemic.

1. Make the most of the power of compound interest

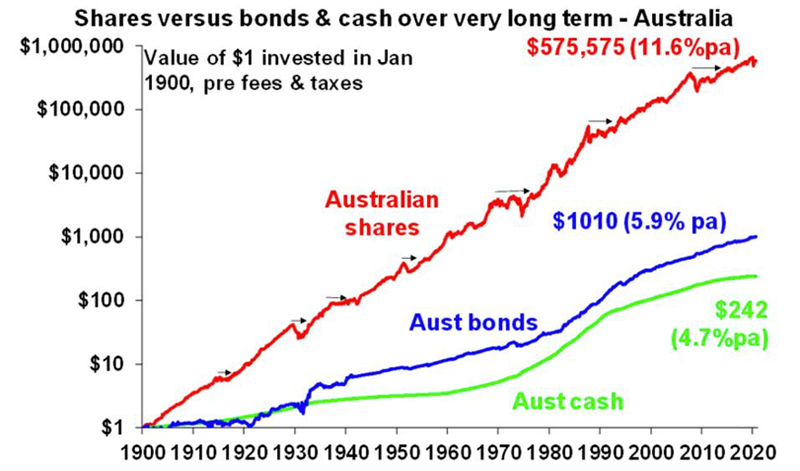

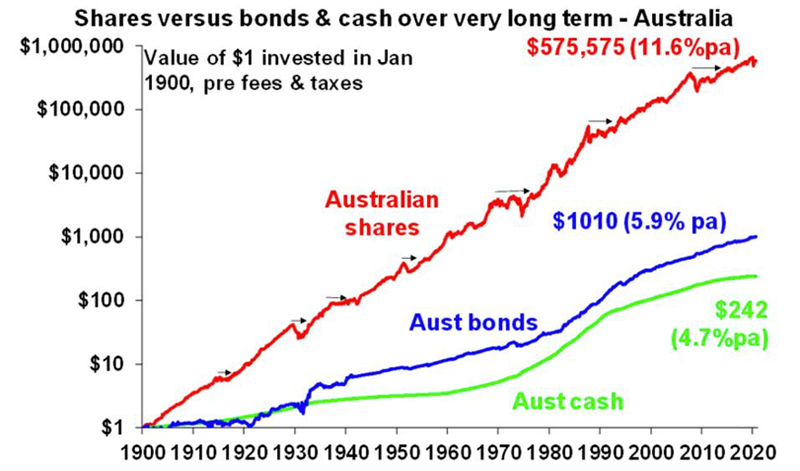

The next chart is one of our favourites and it shows the value of one dollar invested in 1900 in Australian cash, bonds and equities with interest and dividends reinvested along the way. That one dollar would be worth $242 today if it had been invested in cash. But if it had been invested in bonds it would be worth $1,010 and if it was allocated to Australian shares it would be worth $575,575. Although the average return on shares (11.6% pa) is just double that on bonds (5.9% pa), the magic of compounding higher returns over long periods leads to a substantially higher balance. The same applies to other growth assets like property. So, the best way to build wealth is to take advantage of the power of compound interest and have a decent exposure to growth assets. Of course, the price for higher returns is higher volatility but the impact of compounding higher returns from growth assets is huge over long periods.

Source: Global Financial Data, AMP Capital

The coronavirus pandemic does nothing to change this, any more than previous setbacks like WW1 and Spanish Flu, the Great Depression, the 1973-74 bear market, the 1987 crash or the GFC did. The collapse in interest rates and earnings yields means the returns seen over the last 120 years will likely be a lot lower over the next decade. But this partly reflects the collapse in inflation (so in real terms things are not quite so bad). And without getting into forecasting, shares offering a dividend yield of 3.5% (4.5% with franking credits) should provide superior medium term returns and hence grow wealth far better than bonds where the ten-year income is 0.85% pa!!! (which is the return you will get over the next ten years).

2. Don’t get thrown off by the cycle

Investment markets constantly go through cyclical phases of good times and bad. Some are short and sharp, some can spread over many years. But all eventually set up their own reversal – eg. as falls make shares cheap and low interest rates help them rebound. The trouble is that cycles can throw investors off a well thought out investment strategy that aims to meet their financial goals and take advantage of longer-term returns. But they also create opportunities. In a longer term context the roughly 35% plunge and then rebound in shares associated with coronavirus was just another cyclical swing – albeit it occurred faster reflecting the unique nature of the shock which saw a faster than normal hit to economies and then faster than normal deployment of fiscal stimulus and monetary easing. The key was not to get thrown off when markets plunge and stick to your strategy – it was designed to meet your goals.

3. Invest for the long term

This one is a little no brainer. Investing is all about long term returns. If you ever wondered why (or you just can’t remember), it’s because of one thing – inflation. In the long run, the cost of living doubles every 15-20 years and if we keep money sit in the bank account, we’re eroding the purchasing power of what we own.

Looking back, it always looks obvious as to why things happened. But that’s just Harry Hindsight talking! Looking forward no-one has a perfect crystal ball. As JK Galbraith observed “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” Usually the grander the forecast the greater the need for scepticism as such calls invariably get the timing wrong or are dead wrong. If getting markets right were easy, then all the predictors would be mega rich and would have stopped doing it. During the pandemic with all sorts of forecasts as to what it would mean, most of which provided little help in actually getting the market low back in March let alone the rebound. Given the difficulty in getting market moves right in the short-term, it’s best to have a long-term plan, focused on your long-term goals and stick to it.

4. Diversify

Don’t put all your eggs in one basket. Hands up if this is the first time you hear it! It’s a well-known fact that having a well-diversified portfolio will provide a much smoother ride. But for whatever reason, especially when it comes to larger sums of money, we don’t do what we know we should be doing. For example, global and Australian shares provide similar returns over the very long term but in the March quarter this year global shares in Australian dollars fell less than half as much as Australian shares. Similarly, income investors who just had a few Australian bank stocks would have been hard hit by bank dividend cuts earlier this year whereas those with a broader exposure to high dividend paying companies would have seen their dividend income hold up a lot better. Lastly, those property investors, relying only on rental income from tenants would feel a heat not being able to replace them during the pandemic.

5. Turn down the noise

After having worked out a plan and investment strategy that’s right for you, it’s important to turn down the noise. Like most things, it’s easier said than done. The digital world we live in is providing us (minute by minute) with market updates, opinions about economy and what we should do. But much of this information and opinion is of poor quality. As “bad news sells” there has always been pressure on editors to put the negative news on the front page of newspapers. This has gone into hyperdrive through the coronavirus pandemic (as it does through any temporary period of increased uncertainty) – with a massively stepped up flow of economic information (eg the Australian Bureau of Statistics now publishes key jobs reports three times a month and there is now a focus on weekly economic statistics). This may be of use in providing timely information on how the economy is travelling but it’s also added immensely to the flow of information and often its contradictory. This is all leading to heightened uncertainty and shorter investment horizons which in turn can add to the risk that you could be thrown off well thought out investment strategies. The key is to turn down the volume on all this noise.

Contact your planner and talk through your thinking process. This also means keeping your investment strategy relatively simple. Don’t waste too much time on individual shares or funds as it’s your high-level asset allocation that will mainly drive the return and volatility you will get. Here are several tips to help turn down the noise:

- Talk to your adviser. One of the (if not the biggest) values they can provide you with is put things into perspective and help you stick to your plan.

- Recognise that it’s normal for markets to swing from one extreme to another – the volatility is there for a good reason – to deliver premium long-term returns.

- Only follow reliable news (if there’s such a thing) and turn off all “notifications” on your smart device.

- Focus on things you can control. If it’s beyond your control, move on.

- Try to avoid making big investment decisions during the ‘crisis du jour’ until you’re feeling less emotional.

- Don’t’ check your investments on a day to day basis it’s a coin toss as to whether the share market will rise or fall but the longer you stretch it out between looking at your investments the more likely you will get positive news.

6. Beware the crowd at extremes

It feels safe to stick with a crowd (it’s in our DNA) and at times the investment crowd can be right. However, at extremes the crowd is invariably wrong – whether it’s at market highs like in the late 1990s tech boom or market lows like in March 2020. The problem with crowds is that eventually everyone who wants to buy in a boom (or sell in a bust) will do so and then the only way is down (or up after crowd panics). As Warren Buffet has said the key is to "be fearful when others are greedy and greedy when others are fearful". And coronavirus does nothing to change that.

7. Focus on investments with sustainable premium income

If it looks dodgy, hard to understand or has to be based on obscure valuation measures then it’s best to stay away. By contrast, quality assets that generate sustainable income (profits, rents, dividends) and don't rely on debt or financial engineering are more likely to deliver. Again, the coronavirus hit does nothing to change this.

8. Get advice

Last but not least by any means – having a third party, objective point of view to stop us from acting emotionally is money well spent. Given the psychological traps we are all susceptible to (like discounting of the future or tendency to over-react to current investment market conditions), we pay more attention to information and opinion that confirms our own views and the increasing complexity of investing that makes it anything but easy.

A good approach is to seek advice in much the same way you might use a specialist to look after your needs. As with doctors or personal trainers, it’s best to hire service of a professional adviser you are comfortable with and you can trust. All of our planners have planners of their own - to provide valuable third-party perspective and to help them deal with their own emotions and complexities of planning.

In closing, we realise we have sent you more than usual communications this year. It was for a good reason - to explain things and to guide you through an extremely challenging year. The upshot of this is that if you listened, you’d have prospered. Investing needs a lot of patience, cold head and constant guidance. After 32 years of guiding our clients, we can confidently say that knowing what to do is not enough. It’s what we end up doing actually matters to our financial outcomes and that’s why we’re here – to help you do what you might know you need to do, just sometimes your gut feeling says otherwise.

As we wind down 2020 and look forward to 2021, please know that if you let us help you with your decisions, you are well positioned to take advantage of these volatile times. It will surely continue to be a wild ride but that’s what builds long term wealth and prosperity for our advised clients.

Thank you for your ongoing trust.

Bill Bracey FChFP | Managing Director of Sydney Financial Planning

Are you in the best position to take advantage or these volatile times?

Why not book an appointment with one of our planners to review your current situation, contact us on 02 9328 0876.

General Disclaimer: This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Please seek personal financial advice prior to acting on this information.